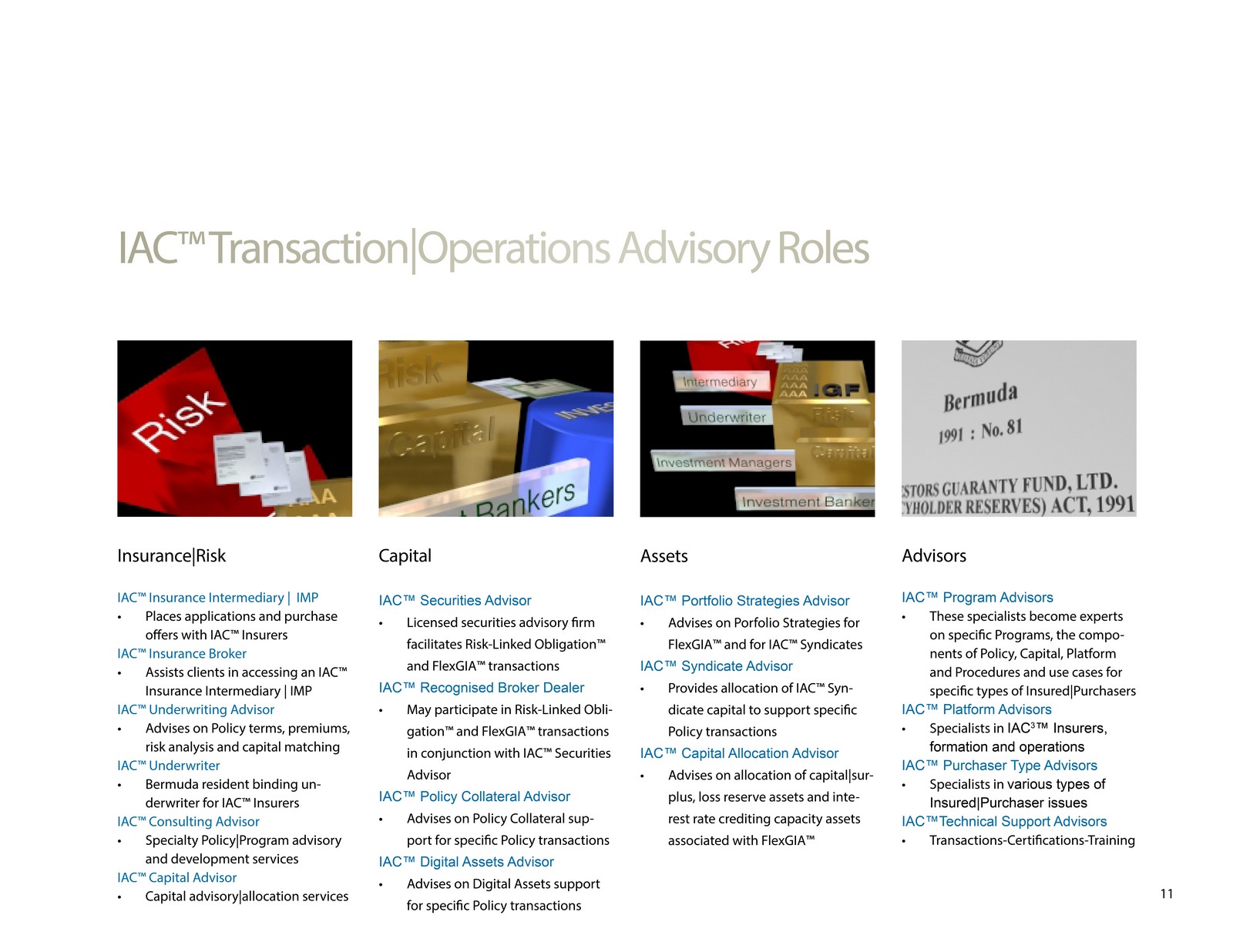

Each IAC™ Insurer is a part of an IAC Cube™, a life assurance, traditional lines and financial guaranty trio of specialty insurers operating under the Investors Guaranty Fund, Ltd. (Policyholder Reserves) Act, 1991 (the "IGF Act").

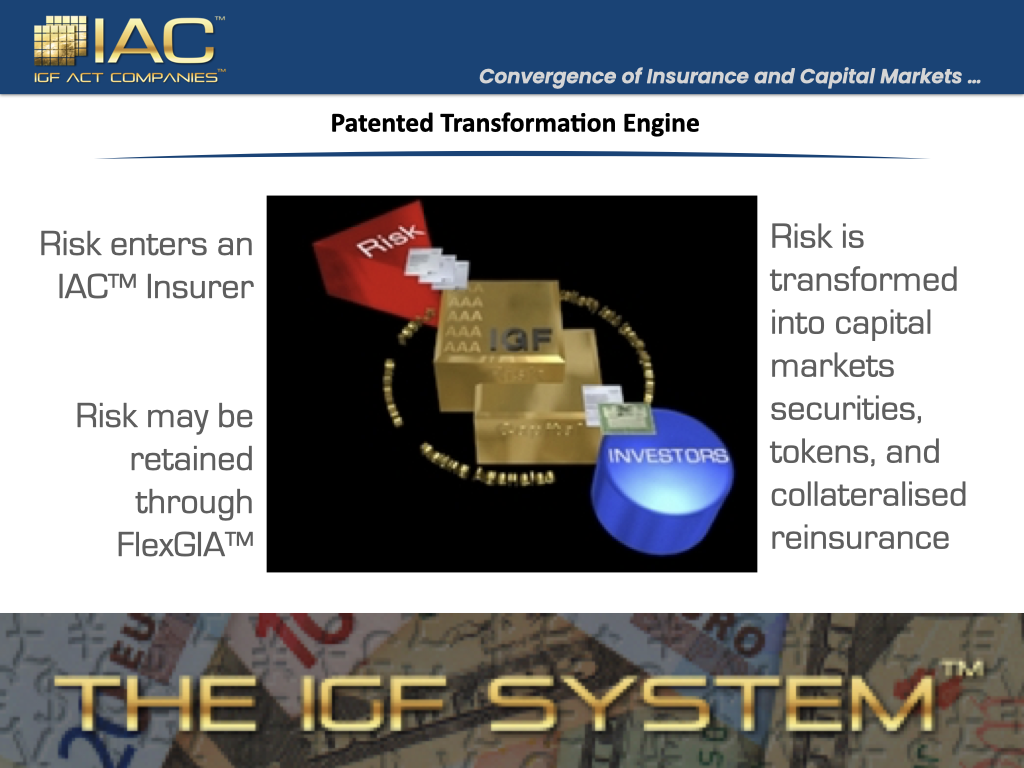

Each operates under The IGF System™ Protocol, a governance protocol designed in conjunction with the IGF Act to enable digital operations of each IAC™ Insurer, as a Digital Infrastructure Utility ("DIU") operating within Bermuda. Global participants may only interconnect through a series of regulated pathways under state-of-the-art nodal mesh networks designed for communication, transacting, persistence, and term of contract+ archiving.

Each IAC™ Insurer is maintained and operated within a discrete quantum component architecture which may only undertake specific permitted activities of an IAC™ Insurer for which it's Board of Directors approves and for which it has been licensed, its use and configuration certified and its IAC™ Marketplace participants accredited.

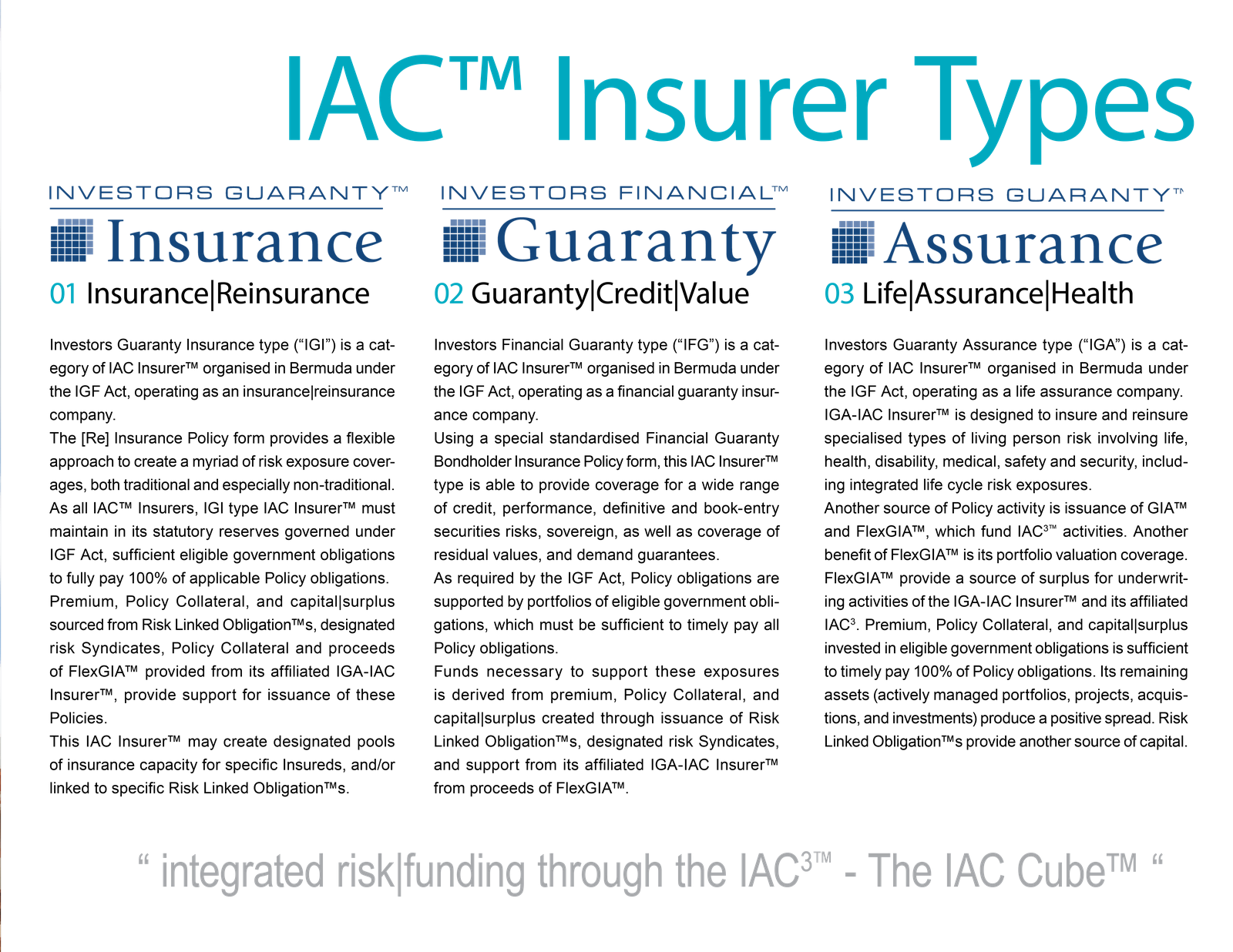

IAC™ Insurers operate on four standard policy forms.

Press Images Below For A More Detailed View of Each Policy Type

IAC™ Insurers operate on five standard policy forms.

PUBLIC ACCESS

For 30+ years IGF and affiliated insurers have provided private risk | funding solutions. Capital holders are private parties including several non-profit foundations.

As IAC™ Insurers transition to a marketplace approach, various forms of public participation are under development.

POLICY HOLDERS

[Re] Insurance Policies, Financial Guaranty, Guaranteed Investment Agreements and FlexGIA™ are held through custodial depositories with regulated fiscal agents, who facilitate initial issuance and applicable payments.

Applications may only be submitted through regulated participants.

CAPITAL PROVIDERS

Policy Collateral, Risk-Linked Obligations, Certificates of Residual Interest are held through custodial depositories with regulated fiscal agents, who facilitate initial issuance and applicable payments.

M

ARKET PARTICIPANTS

Primary risk and funding operations are designed to include regulated insurance and capital markets professionals.

Syndicate participation and digital assets activities are evolving through IGX™ connected third-party infrastructure utilities involving regulated trustees and custodians as required by IGF Act.